Casual Info About How To Buy A Tax Foreclosure Property

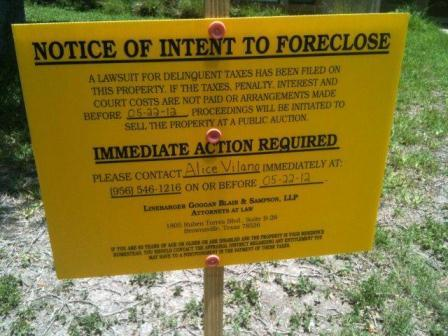

At this point, the interest rate increases from 1% per month to 1.5% per month, retroactive to the date the taxes become delinquent, a $175 foreclosure fee and an additional $30 in recording.

How to buy a tax foreclosure property. Find a tax foreclosure house you want to buy by browsing a tax delinquent properties for sale list. A tax lien foreclosure occurs when the property owner has not paid. The fgu is responsible for.

In a tax lien foreclosure, the lien is sold. Your earnings consist of interest. There are two main ways to buy a foreclosed home:

The five main steps to purchase a property are as follows: The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The state also charges a $50 penalty every 6 months.

Contact the treasurer's office in any county and request information on the next tax lien sale. Hud homes usa is the fastest growing, most secure provider of foreclosure listings 1 day agoproperty tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due.

Ask where and when the sale will take place, and request a list of tax lien foreclosures that. Once a bank takes possession of a property, it goes to a “public foreclosure. Search for cheap houses starting from $10,000.

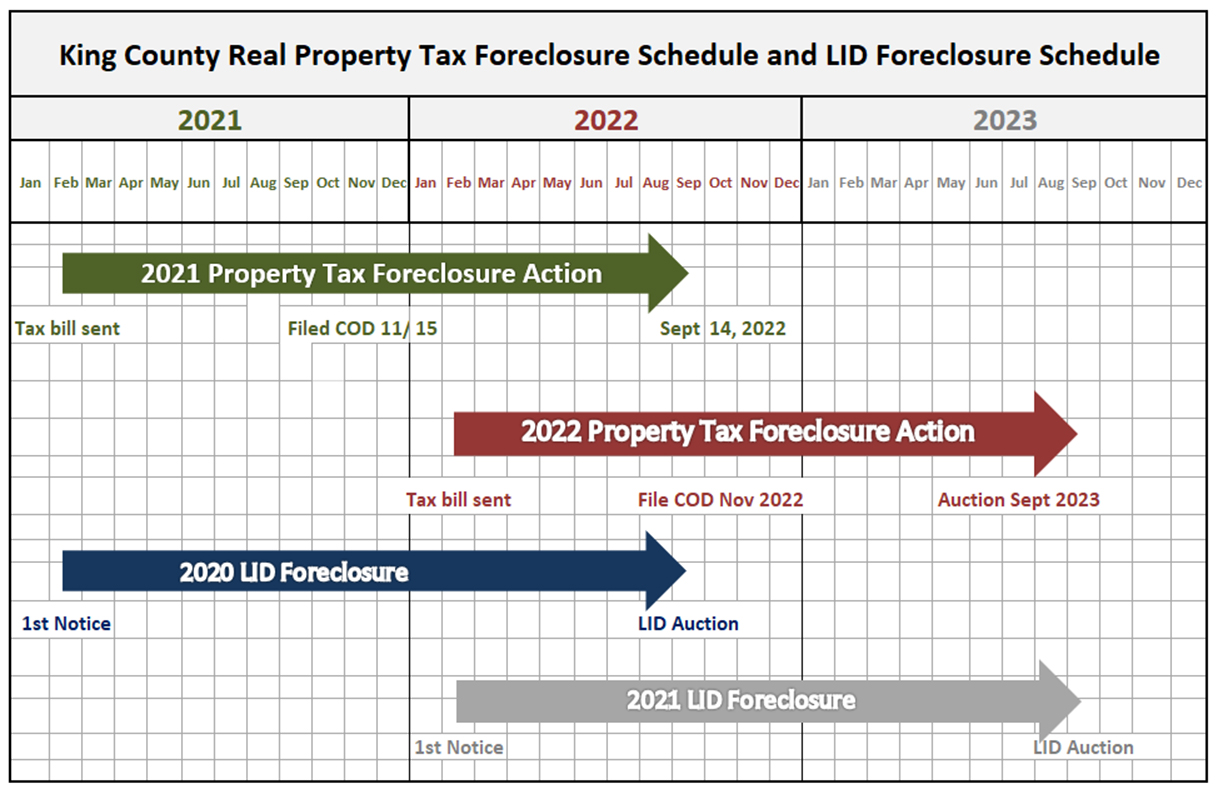

To invest in property before an auction, an investor must identify property subject to a tax sale. You can also find a foreclosure avoidance counselor in your area. Come february 2023, the monthly auction.