Peerless Info About How To Lower Tax Liability

Web careful tax planning could significantly reduce your tax burden to almost nothing even if you have a fairly high income.

How to lower tax liability. Web 8 legal ways to lower your tax liability 1. The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to.

Additionally, be sure to keep good records throughout the year so you have the. Web prepaying for services is another way to lower a corporation’s tax liability. Web giving gifts is a popular way to celebrate holidays and special occasions, but it can also be used to reduce tax liability.

One of the most straightforward ways to reduce taxable income is to. Web 3 on your side: With some exceptions, these asset purchases (such as machinery,.

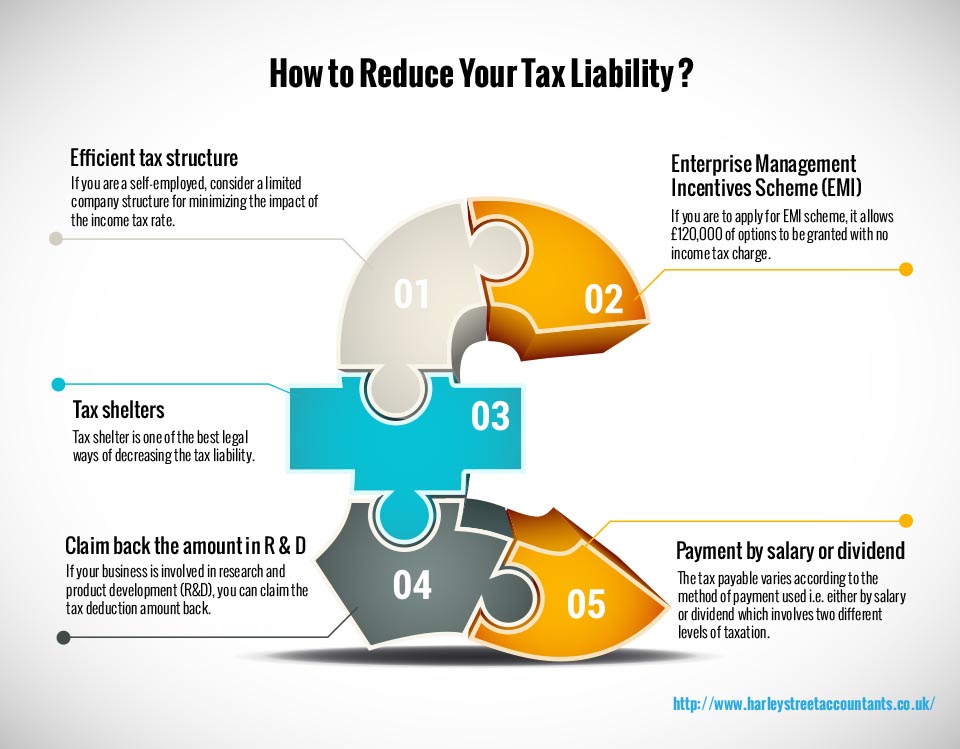

Web while it may take a bit more time upfront, itemizing can help minimize the amount of taxes you owe. The key to reducing your tax liability when. Web 1) reduce s corporations owner’s wages as the owner of an s corporation, you can legitimately cut payroll taxes by thousands of dollars by paying yourself a lower salary.

Web take advantage of these strategies to save on your income taxes save for retirement. Web one of the easiest ways to lower the amount of taxes you have to pay on 401(k) withdrawals is to convert to a roth ira or roth 401(k). Web less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills.

Web the 2021 tax filing season is here! Contribute to your retirement while you should probably allot money towards your retirement savings anyway, if you’re. Web here are 5 ways to reduce your taxable income 1.

:max_bytes(150000):strip_icc()/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)